- Home

- Accounting & Related Services

Navigation

Accounting & Related Services

Five Key Services

We provide five main accounting and related services for our client’s businesses. These services include system setup and design, bookkeeping, basic accounting assistance (i.e. the creation of more meaningful financial reporting), tax preparation/filing, and non-assurance compilation work as outline below:

-

- Help setup a new accounting system for our client.

- Support our client’s existing bookkeeper as a regular accounting advisor, or on an ad hoc or scheduled basis. This may be either a bookkeeping firm that we have chosen to work with or an existing bookkeeper used by the client. Bookkeeping may include: reconciling the banks; posting transactions; payment processing; and payroll preparation.

- Do our client’s year-end bookkeeping including preparing adjusting journal entries.

- Perform a year-end tax preparation/filing service only. Our client’s accounting data may be organized in a spreadsheet, or even using our CaseWare software, for entry into the tax return. However, this is not a Compilation Engagement (see below). There is no related communication presented and no accompanying set of Compiled Financial Information.

- Perform a year-end Compilation Engagement for our client, using our CaseWare software to support the underlying tax filing, whether individual (T2125 business) or corporate (T2). See below for additional details on this work, which has a specified form of communication (a Compilation Engagement Report) plus an accompanying set of Compiled Financial Information.

Notes:

- Our client work often involves a combination of the aforementioned services: e.g. #3 and #4, or #3 and #5, and maybe also #1 and/or #2.

- The five services discussed above exclude assurance engagements such as audits and reviews which are discussed separately on our Assurance Services page. In those engagements, our role involves a much higher level of accounting assistance because of the increased disclosure requirements.

New System Setup and/or Bookkeeping Services

Where we are responsible for helping a client set up a new accounting system, our accounting system of choice is often QuickBooks Online. It’s easy to use and has some appealing expansion, migration and integration features. Payroll with direct pay is also available. Of course, we’ll work with whatever system our client chooses. There are many excellent accounting systems available.

Compilation Engagements – In a Nutshell

Compilation Engagements (#5 above) are typically used for businesses and investment companies, where full accounting disclosures are not required for the bank or another third party, or to support a tax filing. Compiled Financial Information is determined by management to be “sufficient.”

For these scenarios, we use our CaseWare engagement software to prepare the year-end adjusting entries, and generate the compiled financial information including our related professional communication. We’ll also link CaseWare electronically to the related T2 corporate tax return. We then pass the year-end adjustments to our client’s bookkeeper for followup posting in our client’s books of account.

Compilation Engagements – An Updated Standard

The updated Canadian Standard on Related Services (CSRS 4200), Compilation Engagements is effective for Compiled Financial Information for periods ending on or after December 14, 2021. The new Compilation standard replaced the old one (Section 9200 with a “Notice to Reader”) which was in place for almost 35 years. Below are some key points to understand.

a) Three Main Questions

Under the new standard CSRS 4200, we are required to ask our client’s management three questions and then document the responses received, as follows:

-

- The intended use of Compiled Financial Information, including whether it is to be used by a third party.

- If the Compiled Financial Information is intended to be used by a third party, whether the third party is in a position to request or obtain further information from the entity, or has agreed with management on the basis of accounting expected to be applied in preparing the Compiled Financial Information.

- Acknowledgment of the basis of accounting expected to be applied.

b) Basis of Accounting

CSRS 4200 also requires that we add a note to the Compiled Financial Information describing the basis of accounting applied in preparing it. Examples of such bases of accounting are: i) a Cash basis of accounting; ii) a Cash basis of accounting with selected accruals and estimates; and iii) a Basis of Accounting prescribed by a contract or other agreement established by a creditor or a regulator.

c) New Engagement Letter

There is also a new Engagement Letter for clients to read and sign. This is an important step in the engagement so that there are no misunderstandings on the work being done and the results to be achieved.

d) No Assurance for Compilations

Most importantly, under the new standard a Compilation Engagement does not provide any form of assurance on the compiled financial information.

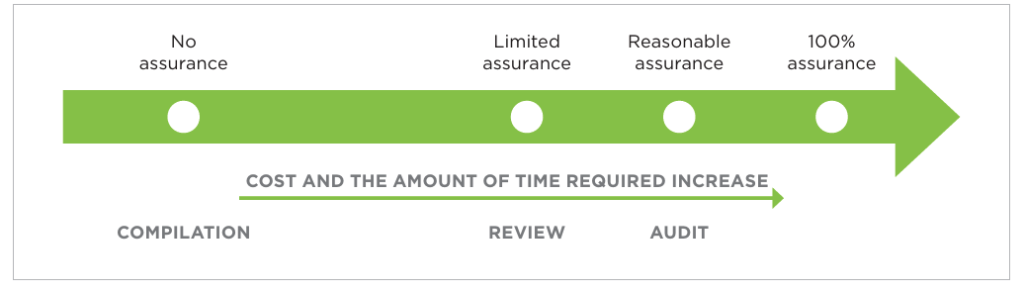

Here’s a link to a CPA Canada document, “Compilation Engagements – Management Briefing“, which explains more about how these “no-assurance” engagements work. Below is an informative chart on Assurance Levels, drawn from that document:

The Bottom Line

At KT Partners LLP, we’re happy to discuss our Accounting and Related Services with you in greater detail.