- Home

- Assurance Services

Navigation

Assurance Services

General Concepts

As independent CPAs holding a Public Accounting License, KT Partners LLP provides Assurance Services to its clients.

These services fall into three main engagement types—Audits, Reviews and Special Work. Professional standards set out the nature of the work involved to support the resulting reports that are attached to the financial statements or other information presented. The goal of this work, and the related reports, is to improve the quality and context of information for decision-makers.

Our team members have the most up-to-date training to ensure that these engagements are carried out in compliance with the latest standards.

We leverage our excellent experience with a broad range of industries, to provide high quality assurance services to clients in an efficient and effective manner. We guide your organization throughout the process, to allow for normal business operations to continue with minimal interruption and overload on your staff.

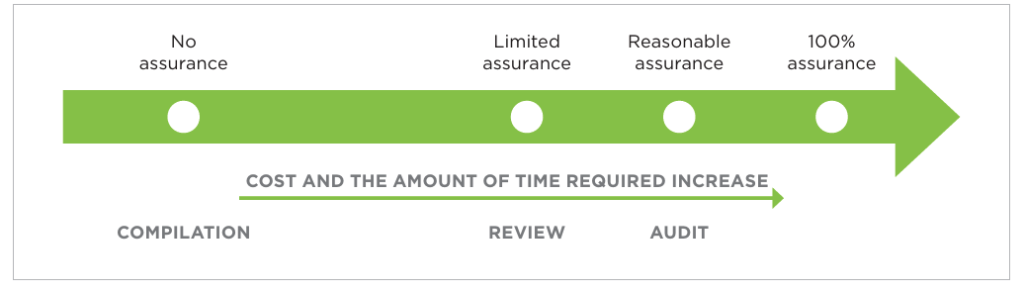

Assurance Levels

Below is a useful chart on Assurance Levels. A copy of this is also presented on our Accounting & Related Services webpage as part of the discussion on Compilations, which are non-assurance engagements.

Audits – The Highest Level of Assurance

In an audit engagement, our goal as auditor is to express an opinion on whether the financial statements are prepared, in all material respects, in accordance with an applicable financial reporting framework and applicable laws or regulations. Management prepares the financial statements with oversight from those charged in the organization with governance.

An audit provides the most assurance to the users of the financial statements and involves the most amount of work. We examine internal controls and we “vouch” transactions to source documents on a sample basis. If the company holds inventory, we attend physical counts and do our own auditor test counts.

In Canada, the financial reporting frameworks that organizations and their auditors deal with are:

- Accounting Standards for Private Enterprises (ASPE);

- International Financial Reporting Standards (IFRS); and

- Accounting Standards for Not-for-Profit Organizations (ASNPO).

We conduct our audits in accordance with Canadian auditing standards and relevant ethical standards and this combination enables us to form our audit opinion. We apply the concept of materiality in our audit planning and execution, and in evaluating the effects of misstatements on the audit and the financial statements. Finally, we exercise professional judgement and professional skepticism at all times during our audits.

Reviews – A Lower Level of Assurance

When appropriate, our team of experienced professionals can alternatively provide a limited assurance-based review of your organization’s financial statements in accordance with the Canadian Standard on Review Engagements (CSRE 2400), Engagements to Review Historical Financial Statements.

In a review engagement, we review the financial statements for overall reasonability by performing procedures such as analytical review, inquiry and analysis to address all material items in the financial statements. We focus on addressing areas in the financial statements where material misstatements are likely to arise. Our Review Engagement Report provides the reader with an appropriate conclusion on the financial statements as a whole.

The same three financial reporting frameworks that apply to audits also apply to review engagements.

We consider the impact of materiality and apply professional judgement in performing our review engagements, but the context is different than for an audit. A review engagement’s level of assurance is, by design, significantly lower than that of an audit engagement.

Special Engagements

We also periodically perform special assurance engagements for clients:

- Attestation Engagements Other than Audits or Reviews of Historical Financial Information (CSAE 3000 Standard);

- Direct Engagements (CSAE 3001 Standard); and

- Assurance Reports on Compliance With an Agreement or Specified Authority (CSAE 3530 and 3531 Standards).

Please contact us directly for more information about this kind of work.

The Bottom Line

KT Partners LLP is pleased to discuss your specific assurance engagement requirements with you, whether you need an audit, review or special work.